Not known Details About Pvm Accounting

Not known Details About Pvm Accounting

Blog Article

Unknown Facts About Pvm Accounting

Table of ContentsPvm Accounting Things To Know Before You BuyThe Main Principles Of Pvm Accounting Facts About Pvm Accounting UncoveredPvm Accounting - QuestionsSome Ideas on Pvm Accounting You Need To KnowAll about Pvm AccountingThe 7-Second Trick For Pvm AccountingSome Of Pvm Accounting

Among the main factors for applying audit in building and construction tasks is the requirement for financial control and management. Construction tasks frequently require significant financial investments in labor, products, devices, and other sources. Correct audit permits stakeholders to check and manage these funds successfully. Bookkeeping systems give real-time understandings into project expenses, income, and profitability, enabling project supervisors to promptly recognize potential problems and take corrective activities.

Bookkeeping systems make it possible for firms to keep track of capital in real-time, making sure enough funds are readily available to cover expenditures and fulfill monetary commitments. Efficient money flow administration helps stop liquidity dilemmas and keeps the job on course. https://canvas.instructure.com/eportfolios/2921746/Home/Navigating_the_Maze_of_Construction_Accounting_A_Comprehensive_Guide. Building tasks go through different financial requireds and coverage requirements. Appropriate audit guarantees that all monetary transactions are tape-recorded properly which the task conforms with accounting requirements and legal arrangements.

An Unbiased View of Pvm Accounting

This minimizes waste and improves project efficiency. To better recognize the value of audit in building and construction, it's also essential to differentiate between construction administration accounting and task management audit.

It focuses on the monetary elements of private building jobs, such as price estimation, expense control, budgeting, and capital administration for a specific project. Both kinds of accountancy are important, and they match each various other. Construction administration accountancy makes certain the business's economic health and wellness, while project monitoring audit makes certain the economic success of specific jobs.

An Unbiased View of Pvm Accounting

An important thinker is called for, that will deal with others to choose within their locations of responsibility and to enhance upon the locations' job procedures. The placement will communicate with state, university controller team, campus department staff, and scholastic researchers. This person is anticipated to be self-directed once the first learning contour relapses.

The 15-Second Trick For Pvm Accounting

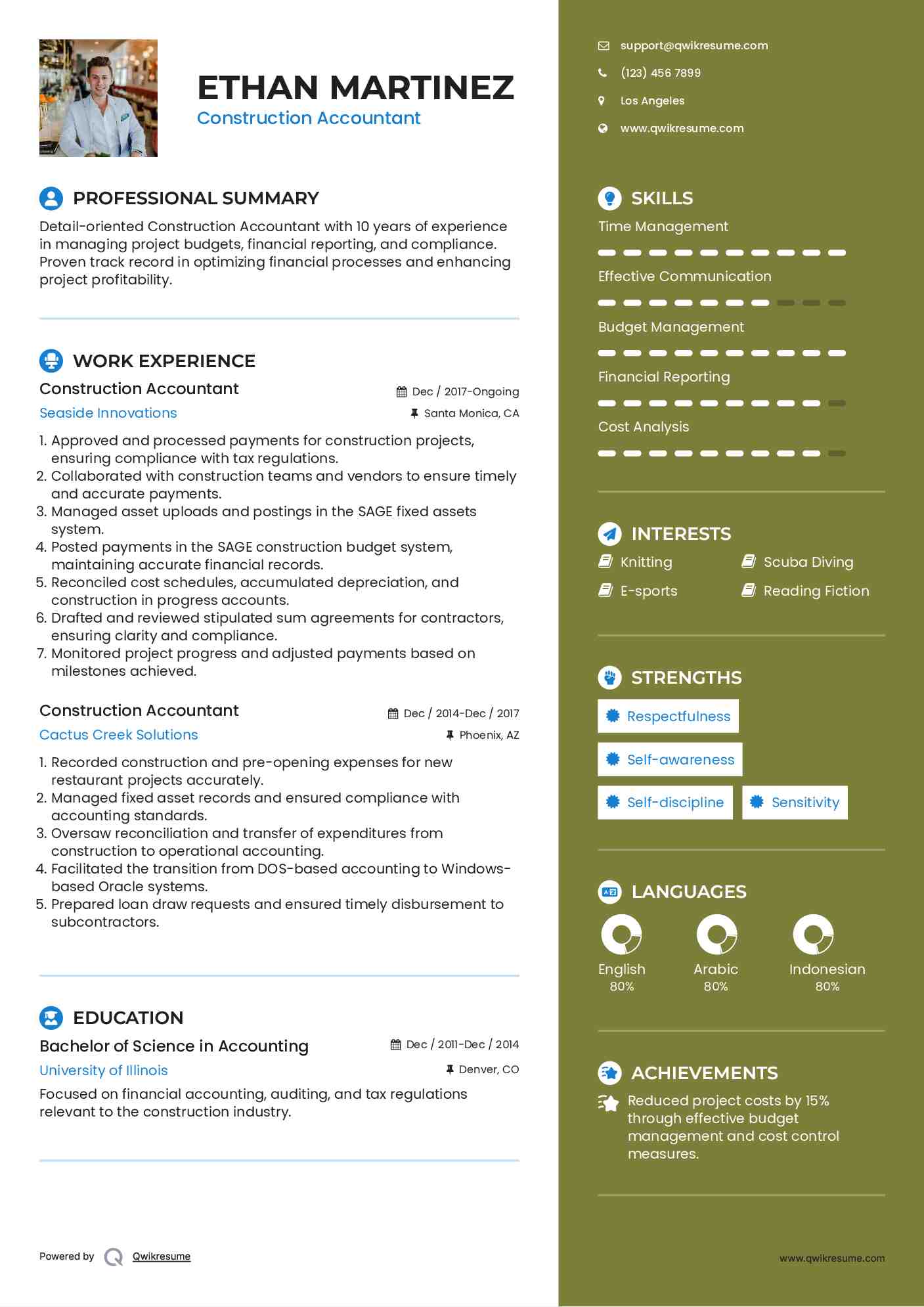

A Building and construction Accounting professional is accountable for handling the financial facets of construction tasks, consisting of budgeting, price monitoring, economic reporting, and compliance with regulatory demands. They work carefully with job managers, specialists, and stakeholders to make certain precise financial records, price controls, and timely payments. Their know-how in construction accountancy principles, task setting you back, and economic evaluation is essential for efficient financial monitoring within the building market.

Unknown Facts About Pvm Accounting

As you've possibly learned now, tax obligations are an unpreventable component of doing business in the United States. While most emphasis usually pushes government and state revenue taxes, there's likewise a 3rd aspectpayroll tax obligations. Pay-roll tax obligations are tax obligations on a staff member's gross income. The revenues from payroll tax obligations are made use of to money public programs; therefore, the funds collected go straight to those programs as opposed to the Irs (INTERNAL REVENUE SERVICE).

Keep in mind that there is an extra 0.9% tax obligation for high-income earnersmarried taxpayers who make over $250,000 or single taxpayers making over $200,000. Earnings from this tax obligation go towards government and state joblessness funds to aid workers that have actually shed their tasks.

Some Known Facts About Pvm Accounting.

Your down payments should be made either on a month-to-month or semi-weekly schedulean election you make before each calendar year (financial reports). Regular monthly settlements - https://www.twitch.tv/pvmaccount1ng/about. A monthly payment should be made by the 15th of the following month.

Take care of your obligationsand your employeesby making complete pay-roll tax payments on time. Collection and repayment aren't your only tax obligation obligations.

A Biased View of Pvm Accounting

Every state has its very own joblessness tax obligation (called SUTA or UI). This is due to the fact that your firm's sector, years in organization and unemployment history can all figure out the percentage utilized to determine the amount due.

Things about Pvm Accounting

Lastly, the collection, compensation and coverage of state and local-level taxes look at this site depend on the governments that levy the taxes. Each entity has its very own guidelines and methods. Plainly, the topic of payroll tax obligations entails lots of relocating parts and covers a wide variety of accounting expertise. A U.S.-based international CPA can draw on knowledge in all of these areas when advising you on your one-of-a-kind organization setup.

This internet site uses cookies to enhance your experience while you navigate via the web site. Out of these cookies, the cookies that are classified as required are kept on your browser as they are important for the working of standard functionalities of the web site. We additionally utilize third-party cookies that help us evaluate and comprehend just how you use this site.

Report this page